Introduction: The Journey Begins

Becoming a parent is often celebrated as one of life’s most rewarding experiences, filled with initial excitement and joy. From the moment a child is welcomed into a family, emotions run high with anticipation and love. However, alongside these feelings comes a significant financial responsibility that can feel overwhelming for many new parents. The journey into parenthood, while joyous, also presents a myriad of financial challenges that require careful navigation.

As parents begin to embrace their new roles, they quickly encounter various expenses associated with raising young children. These costs can accumulate rapidly, starting from the essentials such as diapers, formula, and clothing, to larger investments like childcare services and educational materials. Each stage of a child’s development brings additional financial commitments that can strain household budgets. In fact, many parents find themselves grappling with the reality that ensuring their child’s well-being and development often comes with a hefty price tag.

In this blog post, we will delve into the multifaceted financial challenges that accompany raising young children. We will explore the various types of expenses that parents must consider, from daily necessities to longer-term financial planning for education. Additionally, we will provide insights and tips on how families can manage these costs effectively while still enjoying the journey of parenthood. By understanding both the joyful aspects and the financial implications, parents can better prepare themselves for the responsibilities that lie ahead. This exploration aims to equip them with the knowledge necessary to navigate the financial landscape of parenthood successfully.

Understanding the Costs: Breaking Down Child-Related Expenses

Raising young children involves a myriad of expenses that can accumulate significantly over time. New parents often find themselves navigating a financial landscape that can be both overwhelming and taxing. The primary costs associated with raising children include daily necessities such as food, diapers, clothing, and childcare services. These recurring expenses can quickly add up, making effective budgeting essential for families.

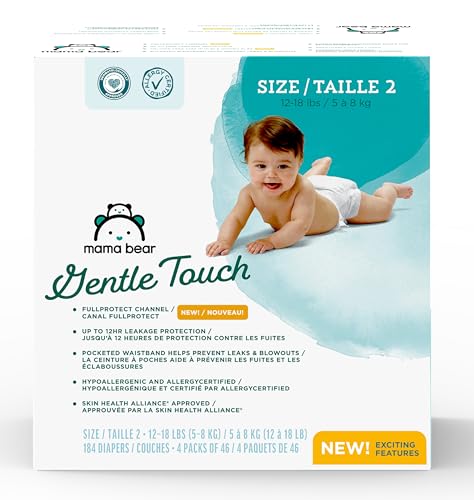

Food costs are one of the most immediate considerations. Depending on the age of the child, expenditures on formula, baby food, and eventually solid foods can range from $100 to $300 per month. This figure will continue to rise as children grow and their nutritional needs become more complex. Similarly, diapers remain a significant expense during the early years, with families spending approximately $70 to $100 monthly until toilet training is achieved. The transition to clothing costs, particularly during growth spurts, can also strain a family’s finances, as children outgrow outfits at a rapid pace.

Childcare is another expense that significantly impacts a household budget. The average annual cost for daycare ranges from $5,000 to $20,000 depending on the location, age of the child, and type of care. Such costs compel many families to explore alternatives, such as family care or flexible work arrangements, to alleviate financial pressures. Additionally, parents may need to make less frequent but essential purchases, including larger items like cribs, strollers, and safety gear. These items typically represent a one-time significant financial commitment, often ranging from $100 to $1,000.

Statistics indicate that families in the U.S. spend an average of $12,000 to $14,000 annually per child in their early years. This amount encompasses various child-related expenses and highlights the financial challenges faced by new parents. Understanding these costs allows families to prepare better and manage their finances while raising young children.

The Emotional Impact: Stress and Financial Strain

Becoming a parent brings immense joy; however, it also introduces a set of financial challenges that can lead to significant emotional turmoil. The initial excitement of welcoming a child is often overshadowed by the anxiety that stems from financial responsibilities. New parents frequently find themselves grappling with concerns over daycare costs, medical expenses, and the inevitable needs of their growing children. This financial burden can manifest as stress, leading to feelings of overwhelm and anxiety.

The impact of financial strain on parental well-being cannot be overstated. Research has shown that stress arising from financial worries can affect personal relationships, strain partnerships, and diminish overall mental health. As families navigate these challenges, parents may experience increased fatigue, irritability, and feelings of inadequacy. The pressure to provide for a family can become an emotional weight that detracts from the joy of parenting and can affect their ability to bond with their children.

To mitigate the effects of financial stress, it is vital for parents to employ effective coping strategies. Open communication with partners about financial matters can help alleviate feelings of isolation and build a supportive environment. Additionally, seeking assistance from financial advisors or utilizing budgeting tools can empower parents to take control of their spending, making their goals more achievable. Engaging in community resources, including parent support groups, can also provide emotional backing as others share similar experiences. Furthermore, parenting courses often cover practical financial advice, equipping parents with strategies to manage costs effectively.

Overall, understanding the emotional impact of financial strain allows parents to address their stresses proactively. Recognizing that they are not alone in facing economic challenges can save new parents from feeling overwhelmed and foster resilience in their journey through parenthood.

Financial Burden of Early Parenthood

The financial burdens that accompany parenthood can be staggering, creating a reality that many families find overwhelming. For many new parents, the moment they welcome a child into their lives, they are also met with a cascade of considerable expenses that can change their financial landscape drastically. From the cost of necessities such as diapers, formula, and clothing to essential items like cribs and car seats, each new addition to the family necessitates a potential re-evaluation of budget priorities. The range of expenses grows as children develop, factoring in childcare, education, and healthcare needs.

The emotional weight of managing these financial responsibilities can lead to significant stress and anxiety. Parents often grapple with feelings of inadequacy as they strive to provide the best for their children while simultaneously balancing their financial constraints. This dichotomy of love and anxiety can often engender guilt when families find themselves struggling to make ends meet. In discussions about the fiscal challenges of parenting, personal narratives can play a pivotal role in illustrating the depth of this experience. Through authentic storytelling, families can share their trials and triumphs, fostering a connection with others who may be in similar situations.

The vivid depiction of a family’s journey can pivot discussions from mere statistics to relatable scenarios, enhancing the emotional engagement of readers. For example, a vivid description of a mother comparing the price of organic baby food to a less costly option can resonate deeply, sparking conversations about prioritizing health versus financial strain. As parents navigate these challenges, adopting a high-performing syntax in discussing their realities aids in emphasizing the gravity of their situations, bridging the gap between statistics and heartfelt experiences. This approach not only informs but also engages readers, compelling them to reflect on the true costs of parenthood.

Smart Saving Strategies: How to Cut Costs

Raising young children can be a financial challenge, but implementing smart saving strategies can significantly alleviate some of the expenses associated with parenthood. One effective way to save money is through bulk buying. Purchasing items such as diapers, baby wipes, and even non-perishable food in bulk can lead to substantial savings over time. Many retailers offer discounts for bulk purchases, allowing families to benefit from lower per-unit costs. Additionally, storing these items adequately ensures that families have a steady supply and can avoid last-minute trips to the store, which often lead to impulse purchases.

Another strategy to consider is taking advantage of loyalty programs offered by various retailers. Many grocery stores and online markets have reward systems that grant points or discounts to regular customers. By signing up for these programs, families can accrue benefits that translate into savings on essential baby and household products. For instance, a family might save 5% to 10% on their monthly grocery bill simply by utilizing the rewards they have accrued over time, making these programs a cornerstone of effective financial planning.

Subscription services like Amazon Subscribe and Save also present an excellent option for managing recurring costs. This service allows families to auto-order items such as diapers and formula at regular intervals, often at a reduced price. Consumers can often save up to 15% off the standard price when using this service, at the same time minimizing the hassle of shopping for these essentials. Many parents report that integrating these services into their budgeting has not only saved them money but also time, reducing the stress surrounding parenting duties. Overall, these strategies provide a practical framework for parents to manage their finances while ensuring they meet the needs of their children.

The Value of Community: Sharing Resources and Support

Raising young children can often lead to significant financial strain on families, emphasizing the need for collaboration and resource sharing within communities. Parents can significantly alleviate some of these burdens by engaging with neighbors and local support networks. The concept of sharing resources, such as baby clothes, toys, and even childcare arrangements, plays a pivotal role in managing overall expenses. Many parents are unaware of the multitude of resources available in their community that can assist them in navigating the costs associated with parenthood.

One effective method for reducing expenditure is organizing clothing and toy swaps within the community. As children grow rapidly, their need for larger clothing sizes and new toys can cause finances to stretch thin. By participating in swaps, parents can exchange items that their children have outgrown for clothes or toys that are new to them, all while avoiding unnecessary spending. Additionally, this practice promotes a sense of sustainability and reduces waste, as items are repurposed rather than discarded.

Another practical solution lies in creating group childcare arrangements. Parents can collaborate with one another to form co-operative childcare groups where they can alternate childcare responsibilities. This approach not only lessens the financial burden of hiring professional childcare providers but also fosters a supportive environment for children, allowing them to develop social connections with their peers in a familiar setting.

Moreover, the emotional support and camaraderie gained through community connections can be just as vital as financial resources. Engaging with other parents can provide much-needed encouragement, advice, and practical help during difficult times, offering a sense of belonging and reassurance. In essence, the value of community extends beyond sharing resources; it cultivates a network of support that can help families navigate the challenges of parenthood more effectively.

Government Assistance and Financial Aid: Exploring Available Resources

Raising young children often comes with significant financial challenges, prompting many families to seek assistance from government programs and financial aid. In various countries, several resources can provide crucial support to parents, particularly those facing economic hardships. Understanding these available programs is essential for families as they navigate the complexities of child-rearing expenses.

One of the primary avenues for financial assistance is through childcare subsidies. Many governments offer these subsidies to help families afford quality childcare services. Eligibility for these programs typically depends on household income and family size, allowing lower-income families to access subsidized childcare, which can alleviate some of the financial burdens associated with working while raising young children. These subsidies may vary significantly by region, so it is advisable for parents to check with their local government or social services for specific details.

Tax credits also play a vital role in reducing the financial load on families with young children. Many jurisdictions provide tax benefits such as the Child Tax Credit or the Earned Income Tax Credit. These credits can significantly cut down an individual’s tax liability, leading to a more manageable financial situation for parents. Some credits are designed specifically to assist with childcare expenses, further ensuring that families can afford to provide adequate care while maintaining employment.

Additionally, numerous local assistance programs exist to help families access basic necessities, including food, housing, and healthcare. These programs may not be exclusive to families with children but can offer essential relief to parents struggling to make ends meet. Parents should explore all avenues of support available to them, as government resources can significantly improve the quality of life for families with young children.

The Long-Term Investment: Understanding the Value of Parenting

Parenthood is often framed within the context of financial challenges, yet it is essential to recognize the profound long-term benefits that come from raising children. While the immediate costs can seem daunting, the value of parenting transcends monetary measures, encompassing emotional, intellectual, and societal returns on investment. Each investment made in a child contributes not only to their personal development but also to the broader tapestry of community and future generations.

The early years of a child’s life are foundational, and the nurturing they receive during this time plays a critical role in shaping their character, values, and capabilities. Through love, patience, and guidance, parents equip their children with the skills necessary to navigate life’s challenges. This emotional investment fosters resilience and adaptability, qualities that can lead to a fulfilling adult life. Furthermore, the benefits extend beyond the individual, as well-adjusted children contribute positively to society, enhancing communal bonds and decreasing future societal costs associated with welfare or criminal justice interventions.

Parenting also offers immeasurable moments of joy and fulfillment that cannot be quantified by financial metrics. The smiles, laughter, and shared experiences create priceless memories that enrich the lives of both parents and children. These moments highlight the transformative nature of parenthood, where love and connection provide a sense of purpose and belonging. As children grow, the lessons learned — from determination and empathy to the importance of community — often reflect back onto the parent, enriching their own lives in unexpected ways.

Overall, while the financial obligations of raising children can be overwhelming, it is important to adopt a long-term perspective. The investment in a child’s future yields returns that significantly outweigh the initial costs associated with parenting. In navigating the complexities of this journey, parents can find comfort in the knowledge that they are shaping not only their child’s future but also contributing to a brighter, more cohesive society.

Conclusion: Navigating Parenthood with Strategy and Support

Raising young children undoubtedly comes with a myriad of financial challenges that can often feel overwhelming. The financial burden of providing for a family requires careful planning and resourcefulness, as parents frequently encounter unexpected expenses, from healthcare to education. However, it is essential for parents to recognize that they are not alone in this journey. There are numerous strategies and resources available to help ease the financial pressures associated with parenthood.

One effective approach is to develop a comprehensive budget that outlines both fixed and variable expenses. This will enable parents to have a clear understanding of their financial situation and make informed decisions. Additionally, utilizing community resources, such as local programs, parenting groups, and financial counseling services, can provide valuable support and guidance. These services can assist parents in identifying assistance programs, which may include subsidies or grants from government organizations that can help mitigate some of the costs associated with raising children.

Moreover, it is beneficial for parents to connect with one another. Forming a community of support provides an avenue for sharing experiences, advice, and resources. This solidarity can alleviate feelings of isolation and stress while encouraging a healthier mindset towards the financial challenges of parenting. It fosters collaboration, wherein parents may share child-care responsibilities or partake in the resale of gently used items to lessen financial burdens.

Ultimately, while the road of parenthood may be financially taxing, a proactive approach combined with an engaged community can significantly lighten the load. By strategically managing finances and seeking help when needed, parents can navigate these challenges with resilience and confidence, maintaining a positive outlook on their parenting journey.